Private funds saw huge growth in the first nine months of the year, despite the outbreak and the shrinking economy, according to data from the Association of Investment Management Companies (AIMC) and the Securities and Exchange Commission (SEC).

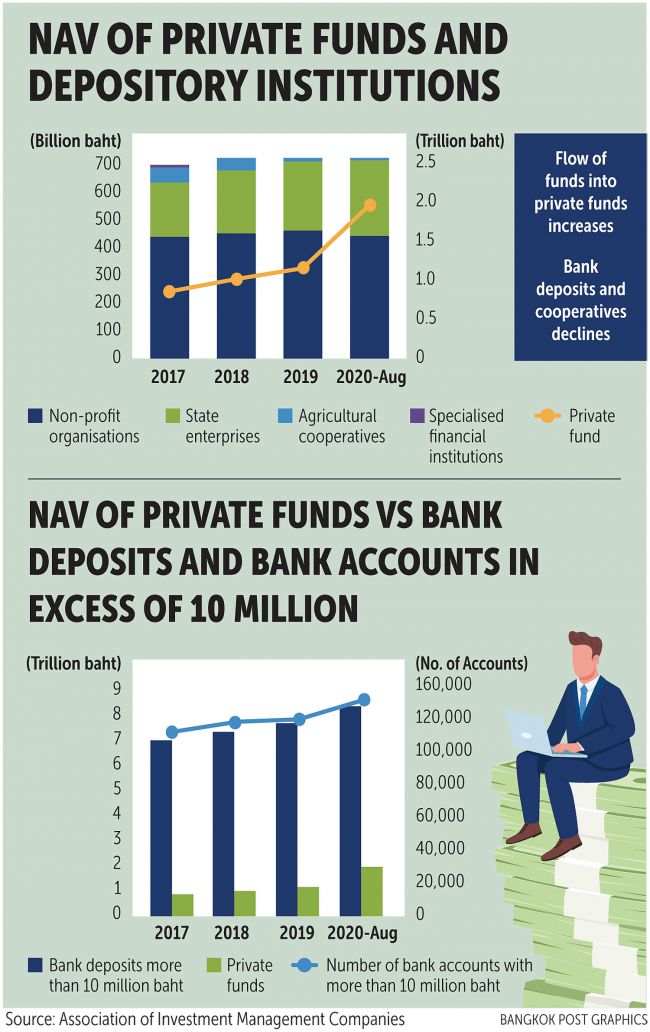

The AIMC reported the size of private funds grew 69.7% over the period, with total assets under management reaching 1.90 trillion baht by the end of September from 1.12 trillion at the end of 2019.

The number of private funds has also doubled from 8,241 to 16,892 at the end of last year, according to the SEC.

“The rapid growth of private equities suggests Thais are diversifying their investments better than in the past,” said Kongkiat Opaswongkarn, chairman at Asia Plus Securities.

He said the factors driving growth of private funds are low interest rates and negative average returns on domestic equities (-20%), which motivated people to diversify investments into foreign markets like the US and China, private equities and safe investment products like foreign bonds.

“Foreign bonds issued by some Thai banks to raise funds from foreign markets also attracted Thai investors,” said Mr Kongkiat.

He said the entrance of new players, especially foreign private wealth management firms, over the past two years pressured local and existing players to communicate more with their customers.

Win Phromphaet, chief investment officer at Principal Asset Management, said the company’s private funds have increased among both high net worth investors and institutional investors, such as insurance companies, government pension funds and cooperative funds.

According to data from the AIMC, savings cooperatives have continued to migrate their funds from bank deposits to private funds over the years in search of higher returns.

Data comparing the net asset value of private funds to bank deposit accounts worth over 10 million baht indicates inflows to private funds from individuals. The vast gap between the two implies high growth potential for private funds going forward.